SmartPoints

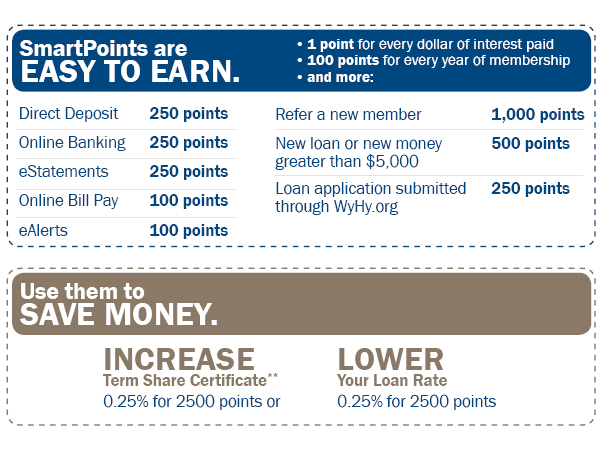

WyHy's SmartPoints is our uniquely designed rewards program to show you, the member, our appreciation for your loyal membership! As a member, you earn 100 SmartPoints for every year of membership — and for every dollar of interest paid or dividends earned you earn one point! And if that isn't easy enough, the more services you add the more points you earn. For example, we award points for direct deposit, Online Banking, Bill Pay, eStatements, eAlerts, new loans and referring a new member.

You don't have to sign-up for anything, or manually track and manage your SmartPoints because you automatically start earning SmartPoints when you perform certain actions, and we take care of all the tracking and management for you. So take a look at the very little you need to do in order to save money on a loan, or earn more on a deposit. It's just another way we thank you for being a member of WyHy.

Could use a break from a monthly payment? We're with you.

Through our Skip-A-Pay program, we offer qualifying members the ability to skip up to two (2) loan payments within a 12-month period without penalty, but interest will still accrue.*

-

$25 fee if done online, $50 fee if done over the phone or at a branch

-

To sign up through Online Banking, log into your account, click on the Services tab, select the Skip-a-Payment option, review the loans you are able to skip and then agree to the Terms and Conditions

-

Great for freeing up some cash for the holidays, vacation — anytime!

*Skip-A-Payment is only offered for certain Auto and Recreational Vehicle loans, Personal/Signature loans, and Certificate Secured loans. All other loans do not apply. Other restrictions may apply. Interest still accrues. For full Skip-A-Pay qualifying loans and program details, please click here or contact us for full details.

Coinstar

WyHy has partnered with Coinstar to offer you additional ways to deposit funds into your account.

You can now securely transfer your coins and cash directly to your checking account from any participating Coinstar kiosk, from your local grocery store to your favorite retail location.

Find a Coinstar Kiosk

Courtesy Pay/Overdraft Protection

With WyHy's Courtesy Pay/Overdraft Protection program, we ensure your payments are covered should your account not have sufficient funds to cover expenses. in other words, instead of returning an item unpaid to the merchant because of insufficient funds, WyHy may pay for the expense up to $500 for a small fee which will save you additional charges from the merchant. The decision to pay certain items in order to cover an overdraft created by check, inperson withdrawal, ATM withdrawal, or other electronic means will be made at WyHy’s sole discretion, as outlined in our full account disclosures. Whether your overdrafts will be paid is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is not in good standing, or you are not making regular deposits, or you have too many overdrafts.

While this is not an invitation to overdraw on your account, it is meant to provide you peace of mind should you accidentally over spend. If you do use this service, you will have 15 days to bring the negative account balance current without penalty. Our members have the choice to opt-in or opt-out of our Courtesy Pay/Overdraft Protection program by writing to or calling us.

Foreign Currency - Currency Exchange International

With our new partner, Currency Exchange International, WyHy is able to provide our members:

-

One-Stop Shopping — Currency Exchange International simplifies your shopping experience by offering over 125 foreign currencies delivered securely via FedEx to your home or office

-

No Hidden Fees — You only pay the current exchange rate plus shipping

-

Delivery — Once the payment clears, the order is shipped for the next business day delivery

-

We Notify You — We place a courtesy call and send an email to alert you that your order is on the way

For more information or to exchange currency, please go to WyHy Foreign Currency Order

Mail Deposits

Members can mail in deposits. Deposits are processed daily and posted on the date received. If deposits are received on Saturday or Sunday, they will be posted the next business day.

Please mail deposits to:

WyHy Federal Credit Union

P.O. Box 20050

Cheyenne, WY 82003

Night Deposit Service

A safe and convenient way to make deposits at the Credit Union after normal business hours.

Notary Services

-

A Notary Public is any person appointed and commissioned by the State to act as a certifying official who attests and authenticates the signature and statement or oath of an individual on a particular document, or any other act that a Notary Public in the State is authorized by law to perform

-

Notary services are free

Official Checks

Funds are drawn from a member's account in check form.

Payroll Distribution

Allows members to have their designated payroll distributed to make loan payment(s) and share deposit(s) within the Credit Union.

Savings Bonds

As of October 1, 2022, WyHy will no longer redeem Savings Bonds.

To assist you in purchasing or selling US Savings Bonds, the following information may be useful.

How to buy EE Savings Bonds? : You can buy EE Savings Bonds Here.

How do I redeem paper Series EE or Series I Savings Bonds? (As an owner or beneficiary): The Federal Government is able to cash your Bonds. Send the bonds to them, along with FS Form 1522. You don’t need to sign the bonds. The form explains how to validate your identity. The form also provides the mailing address.

What if I’m not named on the Bond?

Safe Deposit Boxes (Cheyenne Only)

-

Safe Deposit Boxes are locked storage units within the Credit Union's vault to store valuable personal possessions such as jewelry, special documents, etc.

-

The Cheyenne branch is the only location that offers this service

-

Members may access their box anytime during branch hours

-

Three sizes (and prices) are available

-

For sizes and fees, please refer to our Fee Schedule

SmartPayment Protection

You've worked hard to ensure your financial security. But what would happen to you or the people you care about if there was an accident or you lost your job? SmartPayment Protection can ease the emotional strain of such a loss by relieving some of the financial stress from your loved ones.

SmartPayment Protection Information

Telephone Teller

-

Account access 24 hours a day, 7 days a week using any touch-tone phone

-

Free local, or long-distance phone call

-

Accounts may only be accessed with a specific telephone banking PIN number

-

Contact us to establish your access number, or complete a PIN Application form

TurboTax

Do your own taxes with TurboTax®! WyHy members can save $5 on TurboTax Federal Deluxe edition. Start now and get your guaranteed maximum refund!

Wire Transfers

-

Wire transfers are an easy way to send and receive money to and from another financial institution

-

Wire transfers must be requested in-person

-

For fees, please refer to our Fee Schedule

-

WyHy's Routing Number: 307086691

Wiring Instructions

Sending Money to WyHy

Send to:

Alloya Corporate FCU

184 Shuman Blvd, Ste 400

Naperville, IL 60563

ABA/Routing #271987635

Further Credit to:

WyHy FCU

1715 Stillwater Avenue

Cheyenne, WY 82009

ABA/Routing #307086691

Final Credit to:

-

Member's account

-

Member's Name

-

Member's Physical Address

Sending Money from WyHy Elsewhere

-

The name, street address, city, state, zip code, account number and routing number of the financial institution the funds will be sent to

-

Should the financial institution use an intermediary financial institution like WyHy does, their information will also be needed

-

The full name, account number, street address, city, state and zip code of the person receiving the wire

-

Wires will be rejected if a PO Box is given

Back to Top