Credit 101: Building Your Credit Score

What Goes Into Your Credit Score

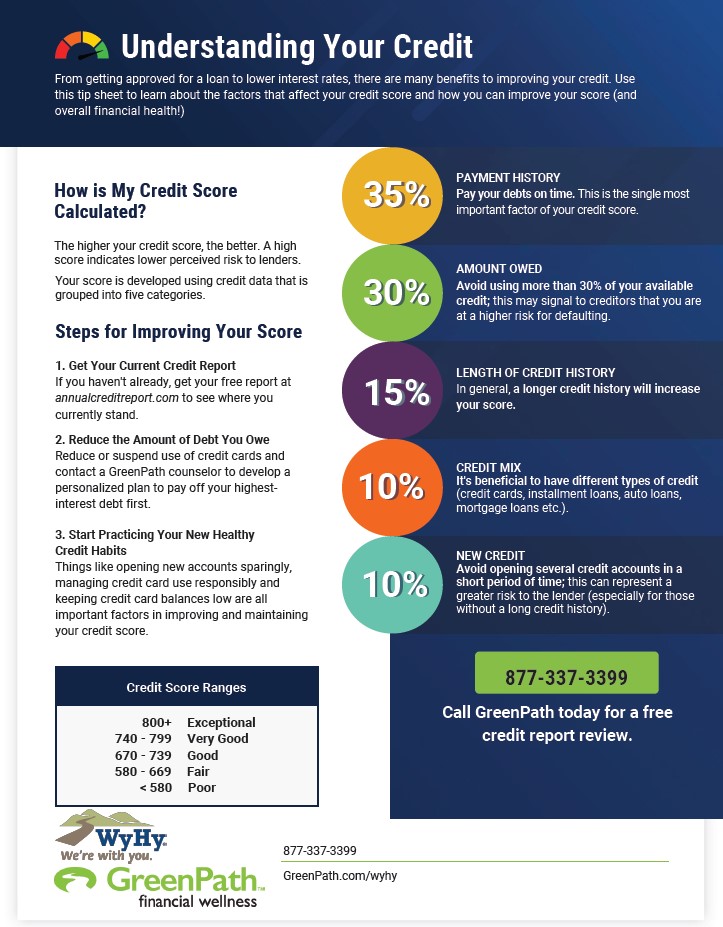

Think of your score as a pie made up of five slices:

-

Payment History (35%) – Always pay your bills on time. Even one late payment can hurt.

-

Amount Owed (30%) – Keep balances low on your credit cards. Using more than 30% of your available credit looks risky. This is known as the 30% Rule.

-

Length of Credit History (15%) – The longer you’ve had accounts open, the better. This is why starting young matters.

-

Credit Mix (10%) – Lenders like to see a healthy variety (credit cards, student loans, maybe even a small auto loan later).

-

New Credit (10%) – Opening too many accounts at once can signal red flags. Be selective.

The 30% Rule

Steps to Start Building Credit

-

Check Your Credit Report

WyHy members can access their credit score for FREE through SavvyMoney in digital banking or the WyHy app. It’s like having a built-in financial coach that helps you see the impact of your credit decisions and plan smarter moves. -

Use Credit Wisely

If you get a credit card, treat it like training wheels. Use it for small purchases (like gas or groceries) and pay it off in full each month. -

Practice Good Habits Early

-

Don’t open too many accounts at once.

-

Pay every bill on time, every time.

-

Review your spending so you don’t get caught off guard.

-