The Credit Union Wealth Group has provided the following Investment Outlook which delivers a concise commentary on their views of the current economy & markets.

Stagflation is defined as a period of slowing economic growth coupled with elevated inflation.

-

Headline inflation in the United States has likely peaked; however, long-term inflation will likely remain elevated at 3%-5%. The massive amount of stimulus injected into the U.S. economy was applied for too long and the Federal Reserve’s tightening is now coming too late with the end result being monetary inflation.

-

Last Wednesday the Federal Reserve raised interest rates another 0.75%. Despite the record pace of rate hikes we believe the Federal Reserve is still behind the curve in catching up to inflation.

-

U.S. worker productivity barely increased in the third quarter and came in below expectations. Productivity challenges are likely to continue negatively impacting GDP growth.

-

The European Union and the UK are likely facing a deep recession as soaring energy costs continue to drive inflation. Europe’s dependence on Russia for energy is resulting in ever more elevated energy prices. Inflation has not peaked in Europe and will negatively impact global growth. h.

Investment updates

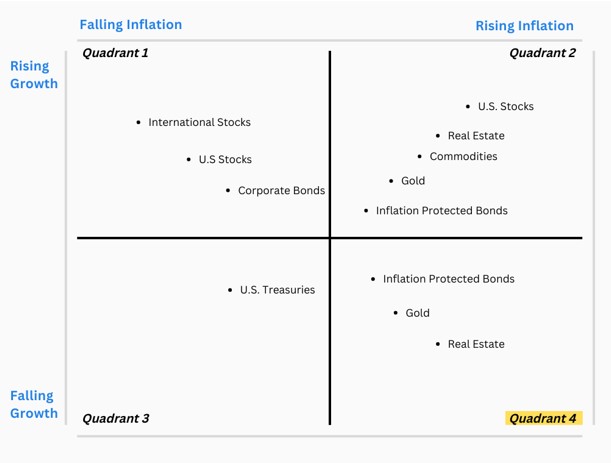

The graphic below displays the general correlation between inflation and economic growth. As you may see, Quadrant 4 on our asset allocation framework represents a stagflationary environment. Historically, in a stagflationary environment, risk assets such as stocks and bonds perform poorly while real assets such as gold, commodities, real estate, and inflation-linked bonds perform well. In April of this year, for members working with our advisors, we began to significantly reduce the stock position in portfolios and reallocated it to cash and ultra-low duration bonds. This reallocation helped to significantly reduce drawdown exposure (risk of losing value) for these portfolios. Going forward we will continue to reallocate to real assets and maintain a conservative allocation in portfolios.

If you would like to speak to one of our financial advisors about an investment account or your personal financial goals please feel free to schedule a conversation using the contact info below.

The below chart provides a framework for understanding how different asset classes have historically performed in various macroeconomic environments.

Your WyHy Advisors:

Evan Kulak | Wealth Advisor

Email: evan@cuwgroup.com

Phone: (307) 365-6069

Michael McDermott | Wealth Advisor

Email: micheal@cuwealth.com

Phone: (307) 365-6073

Financial Planning | Wealth Management | Investment Management | Retirement