.aspx)

What are ARMs?

Adjustable Rate Mortgages, also known as ARMs, are a 30-year home loan type that has a lower interest rate for the first 5, 7, or 10 years of the loan, followed by an adjustable rate after the initial fixed term expires.

Aren’t Adjustable Rate Mortgages dangerous?

ARMs have recently regained popularity after a nearly 14-year decrease in demand following the home loan crisis of 2008-09. Even as demand for ARMs increases many members are left wondering if this is another factor that is setting us up for history to repeat itself, and that simply is not the case. Leading up to the 2008-09 crisis lending regulations were incredibly different from what they are today. Lenders were not required to verify income, employment, or even assets prior to closing on a loan. Since then, safeguards and regulations have been put in place to ensure that every aspect of the application is verified and accurate; thus, resulting in little to no opportunity for “bad loans” like those which contributed to the aforementioned foreclosure bubble. ARMs are no different from a fixed rate loan in that every aspect of the underwriting criteria is verified, often in several ways, to ensure accuracy which ensures borrowers are able to repay the loan payment.

Why are ARMs gaining popularity now?

The recent increase in applications with ARMs as the selected loan type has been spurred by rising interest rates, combined with home prices that have increased an average of 17% over the last two years before finally stabilizing at the higher values. This combination means that buying power has decreased, and homebuyers aren’t able to find the quality of home they envisioned for the amount they are preapproved for with lenders.

What can an ARM do for you?

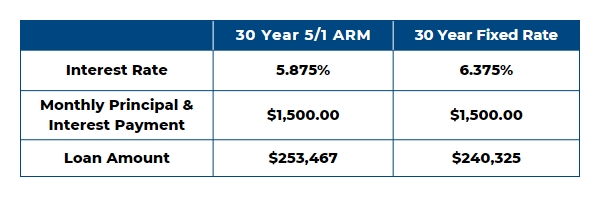

An ARM loan can allow you to qualify for a higher loan amount while keeping your monthly payment the same as it would be on a fixed-rate loan. An ARM with WyHy averages 0.50% less in interest than a fixed-rate mortgage for the same credit score, and down payment. This means that for every $50,000 in loan amount you are saving $150 in monthly payment which allows for a higher purchase price. In this example1 the monthly principal and interest payment is $1500 in both cases, and with an ARM loan the buyer can qualify for $13,142 more in loan amount!

Ready to learn more or apply for an ARM or other home loan product?

Contact our home loan team to discuss whether an ARM is a good fit for your financial goals, and home loan needs. WyHy offers 5/1, 7/1, and 10/1 ARMs as well as various buydown and fixed rate options to meet all of our member’s unique financial situations. Our team will help you determine which program and loan structure is best for you, answer any questions or concerns you have, and assist with getting our simple application process underway.

Schedule a Call With Our Home Loan Expert